Table Of Content

Inflation has slowed but the cost of building materials and labor is projected to remain elevated, meaning the cost to repair and rebuild homes might not decrease anytime soon. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. As a former claims handler and fraud investigator, Jason Metz has worked on a multitude of complex and multifaceted claims.

Evaluate how much of each coverage you need

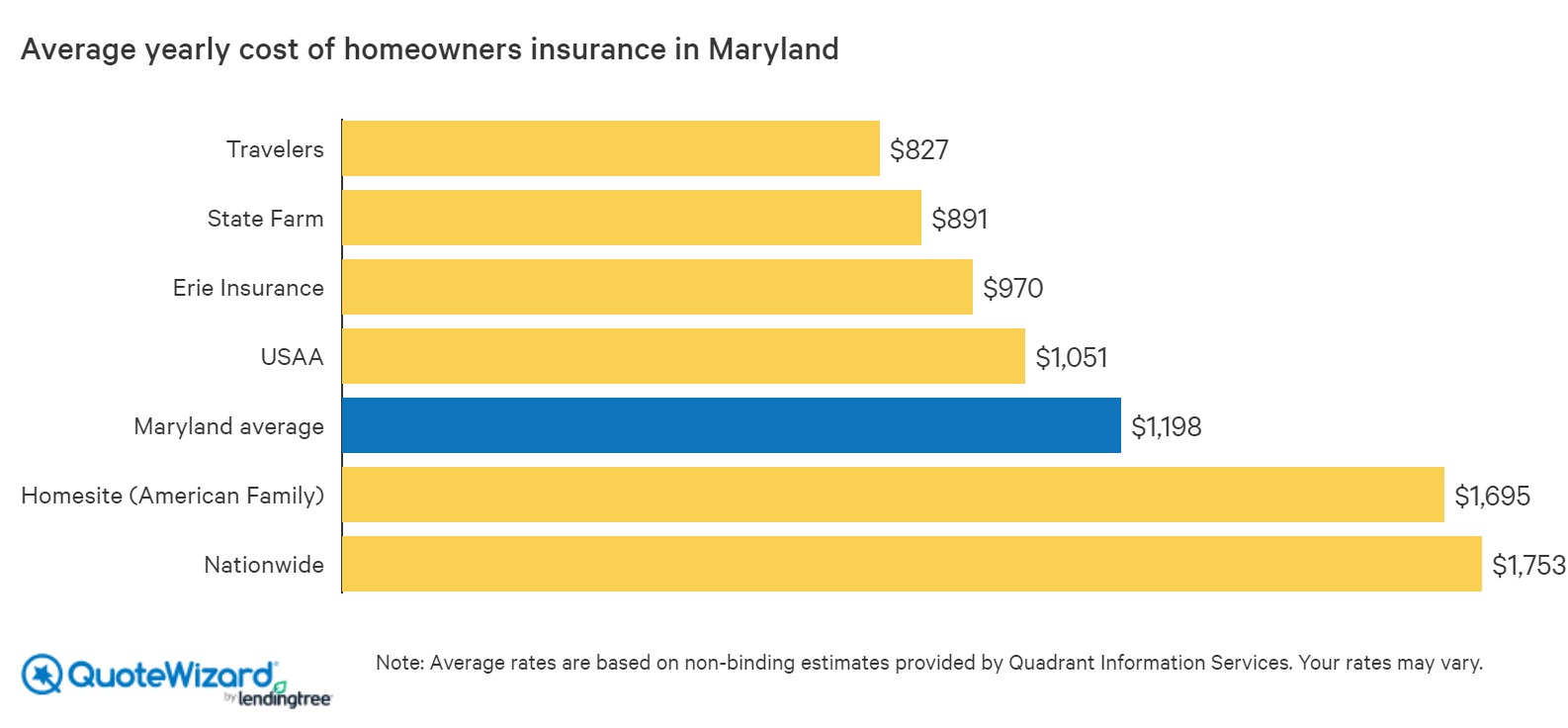

States prone to severe weather like tornadoes and hurricanes are more likely to have higher home insurance rates. Penny Gusner is a senior insurance writer and analyst at Forbes Advisor. For more than 20 years, she has been helping consumers learn how insurance laws, data, trends, and coverages affect them. Penny enjoys translating the complexities of insurance into easy-to-understand advice and tips to help consumers make the best choices for their needs. Her work has been featured in numerous major media outlets, including The Washington Post and Kiplinger’s. For example, concrete block homes may cost less to insure than wood frame houses because they're less susceptible to fires and strong winds.

Arcadia PD searching for robbery suspects who shot into business

Standard home insurance policies also include coverage for other structures, personal belongings and liability, but many insurance carriers offer additional optional coverage types. Knowing how to assess a home insurance quote may help you better understand which carrier might be the best fit for your needs. Perhaps the best way to estimate your homeowners insurance cost is to compare home insurance quotes from multiple carriers (making sure to request the same or similar coverage levels across the board). To determine your personal liability needs, calculate your total assets. Most insurance companies have a cap on personal liability coverage, possibly up to $1 million. However, some high-value home insurers may offer higher liability amounts.

Get a homeowners insurance quote in a few easy steps

Best Homeowners Insurance in New Jersey April 2024 - MarketWatch

Best Homeowners Insurance in New Jersey April 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Each insurer is solely responsible for the claims on its policies and pays PAA for policies sold. Prices, coverages and privacy policies vary among these insurers, who may share information about you with us. PAA's compensation from these insurers may vary between the insurers and based on the policy you buy, sales volume and/or profitability of policies sold. See a list of all the insurers that write Progressive Home policies, or contact us for more details. Aside from coverage amounts, you will also want to take a close look at the deductible, the policy type and whether your belongings are insured on an actual cash value or replacement cost value basis.

Average Cost of Homeowners Insurance FAQs

His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. Increasing your policy deductible, bundling your home and auto insurance with a single company, and adding protective devices to your home like storm shutters and security systems can all get you lower premiums. Also referred to as the home’s replacement cost, this amount is based on how much you’d need to pay to rebuild your home from the ground up at today’s prices with materials of similar type and quality. The best homeowners insurance protects your biggest assets—your home and belongings. Rates vary significantly from one home insurance company to the next, so be sure to shop around with multiple companies when looking for an affordable home insurance estimate.

Best Homeowners Insurance in Minnesota of 2024 - MarketWatch

Best Homeowners Insurance in Minnesota of 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Want to file a complaint against your insurance company? Here’s how:

If you're not up for shopping around yourself, contact an independent agent or broker to get quotes on your behalf. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Find out how much premiums increased in your state by reading our full 2023 Home Insurance Pricing Report.

Best Cheap Homeowners Insurance In California 2024

Liability insurance also covers your legal expenses if you’re sued over the incident. Home insurance costs are easy to estimate if you know how much homeowners insurance you need. Here’s how to determine the best home insurance amount for your situation. Forbes Advisor’s home insurance calculator is a fast and simple way to get an estimate of home insurance costs. Get started by answering a few quick questions to find the cheapest homeowners insurance that matches your needs. Due to the potential for injury, insurance companies consider trampolines and swimming pools to be "attractive nuisances", which may raise the cost of your homeowners insurance.

With inflation and constructions costs showing signs of flattening out and even receding in 2023, it would have been reasonable to assume that home insurance prices may follow suit. You may find that the maximum liability limits available from your home insurance company aren’t enough to properly cover you, based on your net worth. In that case, consider an umbrella insurance policy of $1 million or more.

Average home insurance costs by coverage level

Fitzpatrick earned a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He is passionate about using his knowledge of economics and insurance to bring transparency around financial topics and help others feel confident in their money moves. Below are some of the most asked questions about homeowners insurance. Check our home insurance FAQ and home insurance resources page for more information. Majority of U.S. homeowners may not have enough insurance to rebuild their homes after a disaster like a hurricane, tornado, or wildfire.

Here is the average cost of home insurance per month and annually in each state, along with the percentage difference from the average homeowners insurance cost in the U.S. of $1,754 per year. Your homeowners insurance rate can vary by hundreds or even thousands of dollars depending on the state you live in and whether your home is susceptible to severe storms or natural disasters. Depending on where you live, you can expect to pay anywhere from around $300 a year to over $4,000 a year — a $3,700 difference. To see the typical cost of home insurance where you live, hover over your state on the map below.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. The average cost of homeowners insurance in the U.S. is $2,151 per year for $300,000 in dwelling coverage.

Knowing your home’s characteristics and providing these details to an insurance agent or company will help you accurately determine the cost of rebuilding your home’s structure. To rate each company, we compared average home insurance premiums and discounts, additional coverage options available — like flood endorsements and inflation guard protection, customer satisfaction scores with J.D. Home insurance rates can vary significantly from company to company — even for the same home or coverage amounts. That's because every company has its own way of evaluating risk and determining home insurance premiums.

Of course, no two households that are exactly alike, meaning the cost of your homeowners insurance can vary significantly from someone else’s. Among them are the age, condition and location of your home, the value of your personal property and the types of coverage you hold. All of these and other factors contribute to your homeowners insurance costs calculation. Understanding how to estimate homeowners insurance can assist you in projecting your premium, enabling you to budget accordingly when searching for a new home or considering changes to your current residence. To get a better sense of what your home policy might cost, it could help to review average home insurance rates in your state. Some states may not face a high risk of natural disasters, while others have a cheaper cost of living that makes it more affordable to rebuild after a claim.

He has researched and written about personal finance since 2012, with a special focus on entrepreneurship, freelancing and other small business operations. His writing on insurance and small business has been featured in 7x7, Brit + Co, Intuit Quickbooks, Bankrate, Policygenius and Lendio. This calculator is for illustrative and educational purposes only and is not intended to be a substitute for an insurance quote. Its accuracy and applicability to your circumstances is not guaranteed. You may wish to consult a licensed insurance professional regarding your particular circumstances.

If your house is larger or very customized, you'll likely need more dwelling coverage and will pay higher premiums. However, if your spouse has other personal rating factors that may negatively impact your rates, like a poor credit history, owning and insuring a home together may increase your premium. If homeowners divorce and update their policies, their insurance rates may change for several reasons, including individual rating factors and the change in marital status itself. If the change in marital status impacts the premium, it will likely happen at the next renewal. Hawaii (average of $364 a year) is the cheapest state for homeowners insurance, based on Forbes Advisor’s analysis of average homeowners insurance rates by state.

If you have a mortgage, you can choose to have your lender pay your homeowners insurance bill through your escrow account. Depending on your insurance company, you may be able to divide your bill into installments, have payments taken directly out of your bank account or otherwise pay in a way that’s convenient for you. Typically, you need enough dwelling coverage to pay the cost of completely rebuilding your home.

No comments:

Post a Comment